Get Started With

servzone

Overview

An insurance broker license is issued to an expert and qualified persons or through its directors or partners or workers, has information about insurance related laws and sufficient information on insurance items. They signal individuals on their insurance needs. An insurance broker provides an efficient type of assistance to its client and acts as an intermediary between an insurance agency and an individual who is searching to purchase an insurance policy.

In addition, insurance brokers can be classified into three types.

- Direct Insurance Broker

With the sale and acquisition of the business of insurance, the customer can buy an insurance policy from their site or software and avail the commission from the insurance agency whose policy is sold

- Composite Insurance Broker

It is a type of insurance broker license that requests and organizes insurance or potential reinsurance for its clients in India or possibly with overseas net rewriters as well as safety net providers in exchange for compensation or fees. is.

- Reinsurance Broker

This is a type of insurance broker license, requesting layouts for its clients based in India or plans for additional reinsurance or possibly insurance in exchange for compensation or fees.

Insurance broker license

Insurance broker licenses are regulated and governed by the Insurance Regulatory and Development Authority (IRDA). IRDA also manages the operations and operations of insurance broker licenses.

An insurance broker is an individual or a company registered under IRDA and provides advice on matters related to insurance. This helps the insurer in the process of obtaining insurance coverage from the insurer. An insurance broker is a qualified, expert and professional person who works for the purpose of providing insurance cover. An insurance broker acts as a bridge between the insurance company and the customers who are wandering in search of buying an insurance policy. The insurance broker license should fall into any kind of classification according to these guidelines:

- Direct Insurance Broker License – Capital required Rs 75 Lac

- Composite Insurance Broker License – Capital required Rs 5 Crore

- Reinsurance broker License – Capital required 4 Crore

Who can apply for an insurance broker license?

List of people who can apply for insurance broker license in India:

- Any company registered under the Companies Act, 2013

- Any registered co-operative society established in accordance with the norms of the Co-operative Societies Act, 1912 or any other similar law

- Any LLP registered under the Limited Liability Partnership Act, 2008

- Any other person accepted by the authority

If the insurance broker license applicant is a registered LLP, none of the following can be a partner of the same

- Non-Resident Unit

- Any foreign LLP is registered according to the law of the foreign country

- Any person who lives outside India

Insurance broker license functions

Direct Broker Functions

- Acquiring complete information related to business and risk management strategy of the client;

- Getting familiar with the client’s Information of business nature and underwriting that will help you explain things related to the business to the insurer and others;

- Suggesting appropriate insurance cover and conditions;

- Knowledge of available insurance markets;

- The insurer provides a quote about the customer's idea.

Functions of a Re-Insurance Broker

- Familiarizing with the client’s business nature and risk retention strategy;

- Maintaining clear and healthy records of the insurer’s business;

- Advising on insurance cover and various types of insurance cover matters in the international insurance and reinsurance markets;

- Creating a database of available reinsurance markets that also includes solvency ratings of individual reinsurance markets;

- Protecting reinsurance to deliver risk management services;

- proposing a reinsurer or a group of reinsurers;

- Doing negotiations with a reinsurer on the client’s behalf;

Functions of a Composite Broker

Composite Broker handles all operations performed by Direct Broker and Re-Insurance Broker.

Validity and & Renewal

The certificate of insurance broker license is given for three years from the date of issue. An application for renewal of registered insurance broker license is filed at least one month before the expiry of these three years of registration.

License Fee

The fee for the insurance broker license is presented in Schedule I of Form D

.

Non-refundable application fee

- For Direct Broker – Rs. 25,000

- For Reinsurance Broker – Rs. 50,000

- For Composite Broker – Rs. 75,000

Registration Fees for Fresh Registration

- For Direct Broker – Rs. 50,000

- For Reinsurance Broker – Rs. 1,50,000

- For Composite Broker – Rs. 2,50,000

Renewal Fees for a period of 3 years

- For Direct Broker – Rs. 1,00,000

- For Reinsurance Broker – Rs. 3,00,000

- For Composite Broker – Rs. 5,00,000

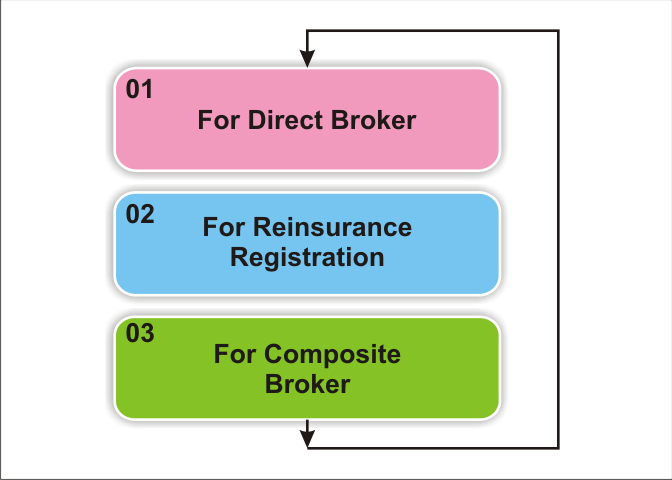

Minimum Financial Requirements

An applicant with the following minimum capital requirement can apply for insurance broker registration:

- For Direct Broker - Rs 75 Lakh

- For reinsurance registration - Rs 4 crores

- For Composite Broker - Rs 5 Crore

Net Worth Requirement

During the process of registration of insurance broker license, it is necessary for the insurance broker to maintain a minimum net worth

- For direct broker - Rs 50 lakhs

- For reinsurance and overall broker - 50% of minimum capital requirement

Deposit requirement

The applicant is required to deposit some amount with the designated bank. Be sure to deposit the amount before applying for registration and during insurance broker license.

- Direct Broker - Rs 10 Lakh

- Reinsurance and Aggregate Broker - 10% of minimum capital requirement

Required Documents

In order to obtain an insurance broker license it is necessary to submit all the necessary documents and information.

The following are the documents that an applicant has to submit along with the information specified in Schedule C of Form C of the IRDA (Insurance Broker) Regulations 2018:

- Form B is required to fill an application for an insurance broker license

- Copy of MOA and AOA

- Identifying data with the Principal Officer and whether they meet fit and valid measures I should be introduced in Form G of Schedule G. Ensure that necessary preparation compliance is satisfied before submitting the application.

- The Director / Officer and other key administrative task forces as well as a confirmation from the Principal Officer expressing this are not experiencing any exclusion as expressed in Section 42D of the Act.

- Complete nuances of directors / associates, advertisers and other key administrative staff.

- List of at least two qualified agents with their own capabilities. This is important because they will be accountable after answering for all requests and obtaining insurance business.

- Complete bank account information

- Principal bankers' nuances with statutory advisors.

Insurance Registration Process

- An insurance broker license application duly filled in Form B given in Schedule I of the Guidelines is to be placed by the candidate together with the authority with non-refundable application expenses and necessary documents.

- After scrutiny of the application for insurance broker license, if the authority has any inquiry, it can contact the candidate for data, documents or direct them to give consent for any requirement.

- Such data, report or explanation is required of the candidate within 30 days from the date of such correspondence as the case may be.

- In the event that after the application for insurance broker license is thought of and if the candidate fulfills all the conditions mentioned earlier, the authority will give a principled approval for insurance broker registration.

- After a basic level approval issue, the candidate is required to agree to additional requirements and send the insurance broker license expenses to the web with the authority.

- If the authority is fulfilled that all necessary conditions are expressed in the Act, Guidelines, Rules, Flyers and so on, which are fulfilled with the conditions expressed by the candidate on the declaration of approval at a basic level, At that time it will be completed. Give a certificate of registration in Form J recommended in Scheme 1

GST Registration

PVT. LTD. Company

Loan

Insurance